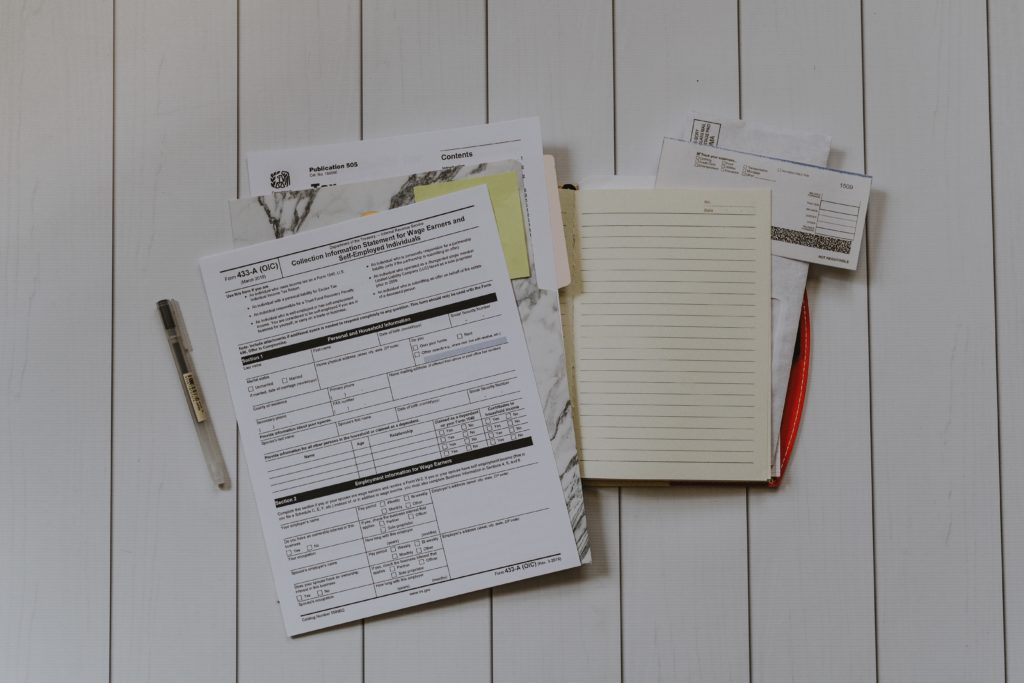

How Much to Withhold From Your W-4s

If you find your tax refund is not as large as you hoped it would be, it may be time to look at your withholding allowances. The number of allowances claimed on your W-4 determines the amount of tax withheld from your income. Too little tax being withheld each paycheck trickles down and affects the […]

How Much to Withhold From Your W-4s Read More »