How do I Find the Right Tax Preparer?

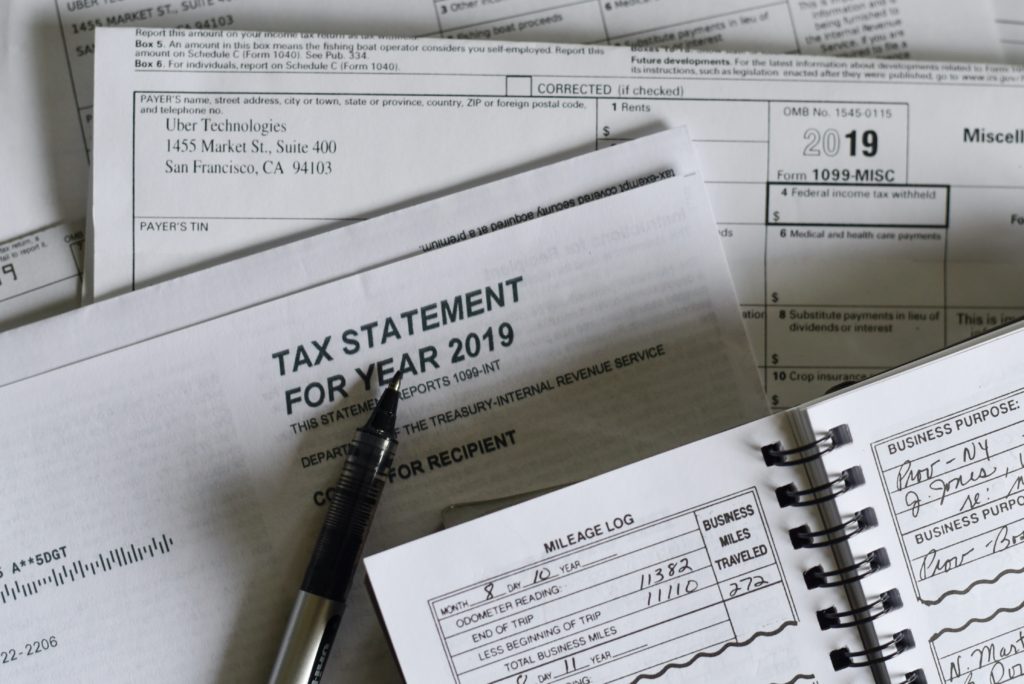

Finding the right person or firm to prepare your taxes is an important choice. You want someone who will do the research to get you the best possible refund for your situation. Of course, you need someone who is ethical and responsible. You also do not want to pay more than necessary or wait forever […]

How do I Find the Right Tax Preparer? Read More »